In recent coverage of SpaceX’s string of failures, we’re seeing a pattern in space journalism that prioritizes harmful launch frequency over safety and environmental concerns. Much like tobacco companies always touted product launch figures while downplaying cancer risks, today’s space coverage celebrates catastrophic cadence while minimizing the increasingly awful consequences of an unsustainable approach to orbital privatization.

A recent glowy showy Ars Technica article exemplifies this problem, framing SpaceX’s horrible ongoing technical failures as mere “bumps” while emphasizing random market numbers as the only concern. Consider this excerpt:

For all of the problems described earlier, the company’s only operational payload loss was its own Starlink satellites in July 2024 due to a second stage issue. Before that, SpaceX had not lost a payload with the Falcon 9 in nearly a decade. So SpaceX has been delivering for its customers in a big way.

SpaceX has achieved a launch cadence with the Falcon 9 rocket that’s unmatched by any previous rocket—or even nation—in history. If the SPHEREx mission launches tonight, as anticipated, it would be the company’s 27th mission of this year. The rest of the world combined, including China and its growing space activity, will have a total of 19 orbital launch attempts.

This framing applies a 1930s industrial mindset to what is fundamentally a 21st-century environmental crisis in the making.

Yes, I said 1930s. Factory workers turned into slaves pushed beyond safety limits would surely improve market dominance, don’t you think? I mean workplace fatalities would just be a “bump”, a literal human being literally run over to keep launch rates up despite hidden costs, so therefore…

The journalist celebrates SpaceX for “flying circles around its competition” while only briefly acknowledging that means debris from their failures has crashed into Poland, created “fiery debris trails over the Bahamas,” and forced air traffic controllers to divert “dozens of commercial airline flights.”

More like flying in circles because it can’t fly straight. SpaceX is really smoking now! 9 out of 10 doctors say circles make you more popular with the ladies. And so forth.

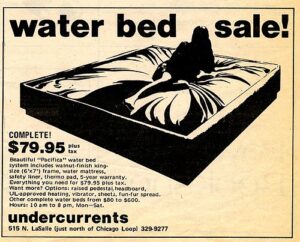

Cigarettes as Space Marketing

SpaceX consistently failed to deliver on its most known, most high-profile promises. Mars missions originally slated for 2018 remain a failure every year for seven years now. This, despite public rocket programs successfully landing on Mars since 1976. For some reason certain 1930s-sounding space media continues to normalize horrible setbacks and long-term failures while celebrating instead a rapid “chain-smoking” instant gratitication approach to launches.

What’s clearly missing from coverage?

- Atmospheric Impact: Recent research indicates that high-frequency launches are damaging Earth’s atmosphere in ways we’re only beginning to understand.

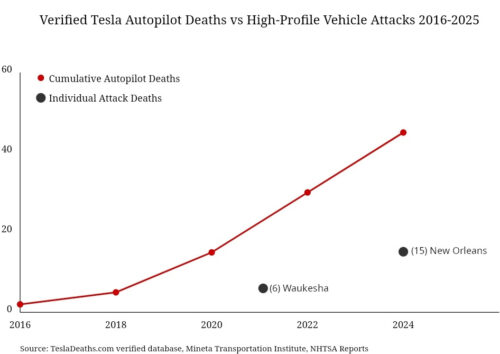

- Accelerating Debris Crisis: Starlink satellites are reportedly deteriorating faster than planned, creating a vicious cycle of more launches and more potential debris.

- Resource Sustainability**: The current model of disposable satellites and rapid replacement represents a fundamentally unsustainable approach to space utilization.

- Safety Concerns: Debris falling on populated areas shouldn’t be treated as an acceptable cost of doing business.

Beyond Marlboro Man Propaganda

SpaceX, led by a suburban South African who likes to cosplay as an American cowboy, positioned itself as the Marlboro Man of space. Projecting an image of lawless frontier expansion however didn’t escape reality, which involves significant risks to our shared environmental resources. Their high-profile objectives (Mars, lunar landings) remain embarrassingly unfulfilled, while their day-to-day operations clearly cause cumulative, long-term damage.

Indeed, the Marlboro Man died a horrible painful slow death, the price apparently of promoting lung cancer.

Lawson isn’t the only former face of Marlboro to die from smoking-related diseases. Wayne McLaren, who appeared in Marlboro print ads, died of lung cancer in 1992, and David McLean, who appeared in print and television spots, died of lung cancer in 1995.

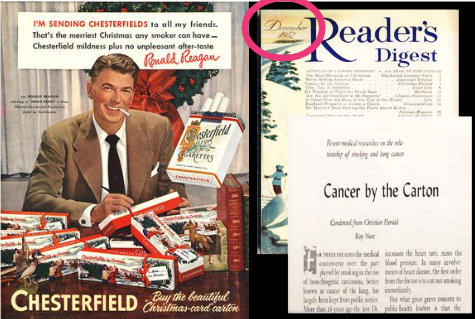

The danger in current space journalism is that it inadvertently normalizes this model, treating harmful launch frequency as the only real metric of success much like cigarette companies once celebrated market share without questioning the actual evidence of impacts. Cancer was known to be the smoking problem by the 1950s, and yet at least 16 million Americans died from it after that point.

We need a new framework for evaluating progress in space that considers not just the quantity of launches but their safety record and list of harms. Otherwise, we risk applying ancient, self-defeating, industrial-era thinking to a problem that requires a much more sophisticated understanding of our relationship with orbital space and our atmosphere.

The Manhattan Project arguably killed more Americans due to radiation effects than the resulting bombs killed Japanese. That’s no way to run a war. And we know conclusively the Japanese didn’t even register the two bombs as impactful, relative to the previous months of conventional weapons. But that’s real history, as opposed to the 1930s-era industrial marketing and propaganda of faster, bigger, more!

When journalists celebrate SpaceX “launching 150 times a year and building two second stages a week” without adequately questioning the sanity of a chain smoking addiction model for lighting up another rocket, they become part of the problem – enablers of a potentially disastrous relationship with our orbital future that generations will mourn.

Looking back at tobacco coverage, historians and public health experts now criticize the “balanced” journalism that gave equal weight to industry product launch claims and health concerns for decades while real harm was done.

The “both sides” approach to tobacco reporting is now seen as a tragic mistake that delayed public understanding and regulatory action, potentially costing millions of lives.

When discussing potential large-scale environmental damage of SpaceX, the appearance of neutrality can itself become a form of bias; one that typically favors established commercial interests over longer-term far more valuable public goods.